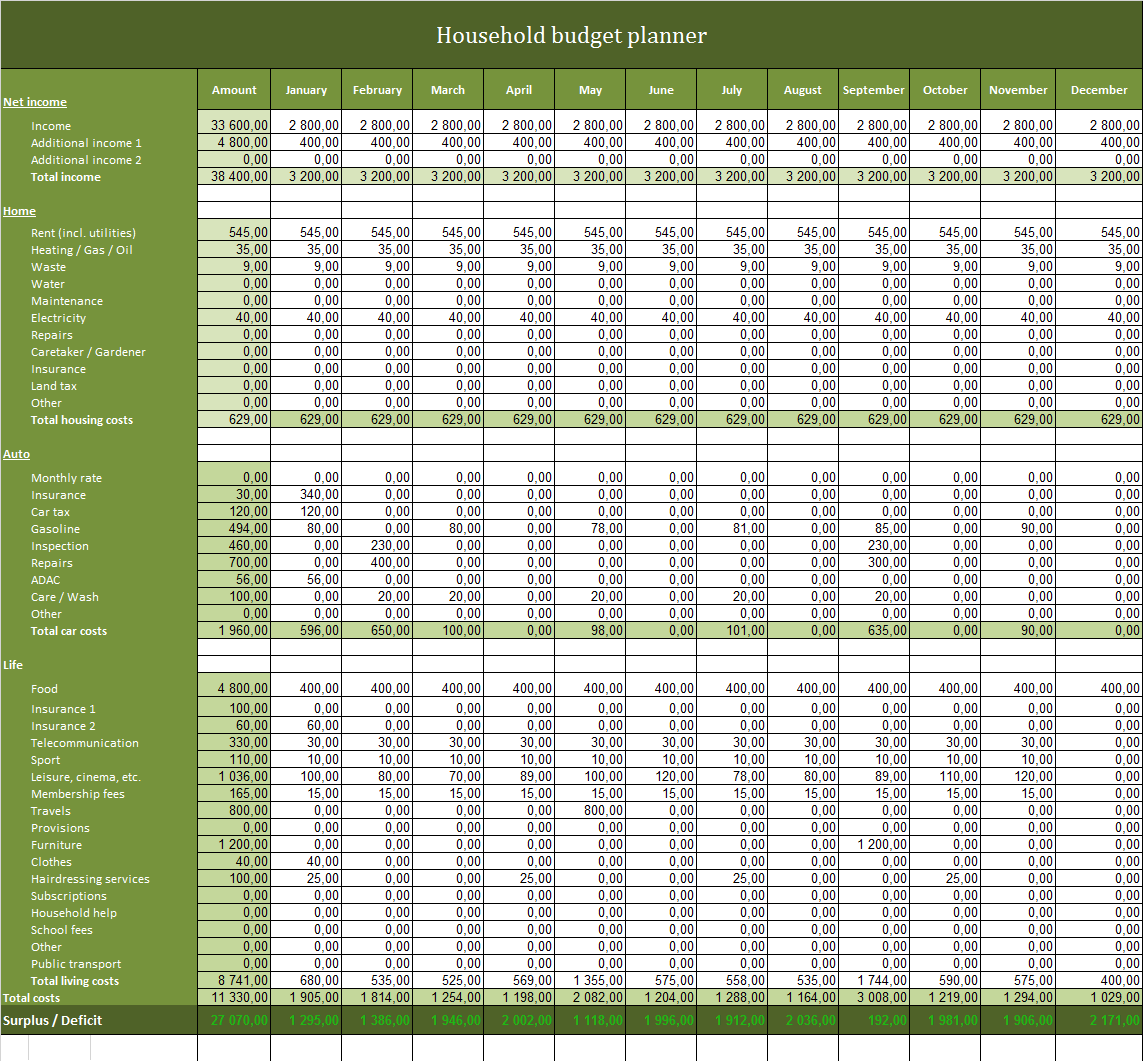

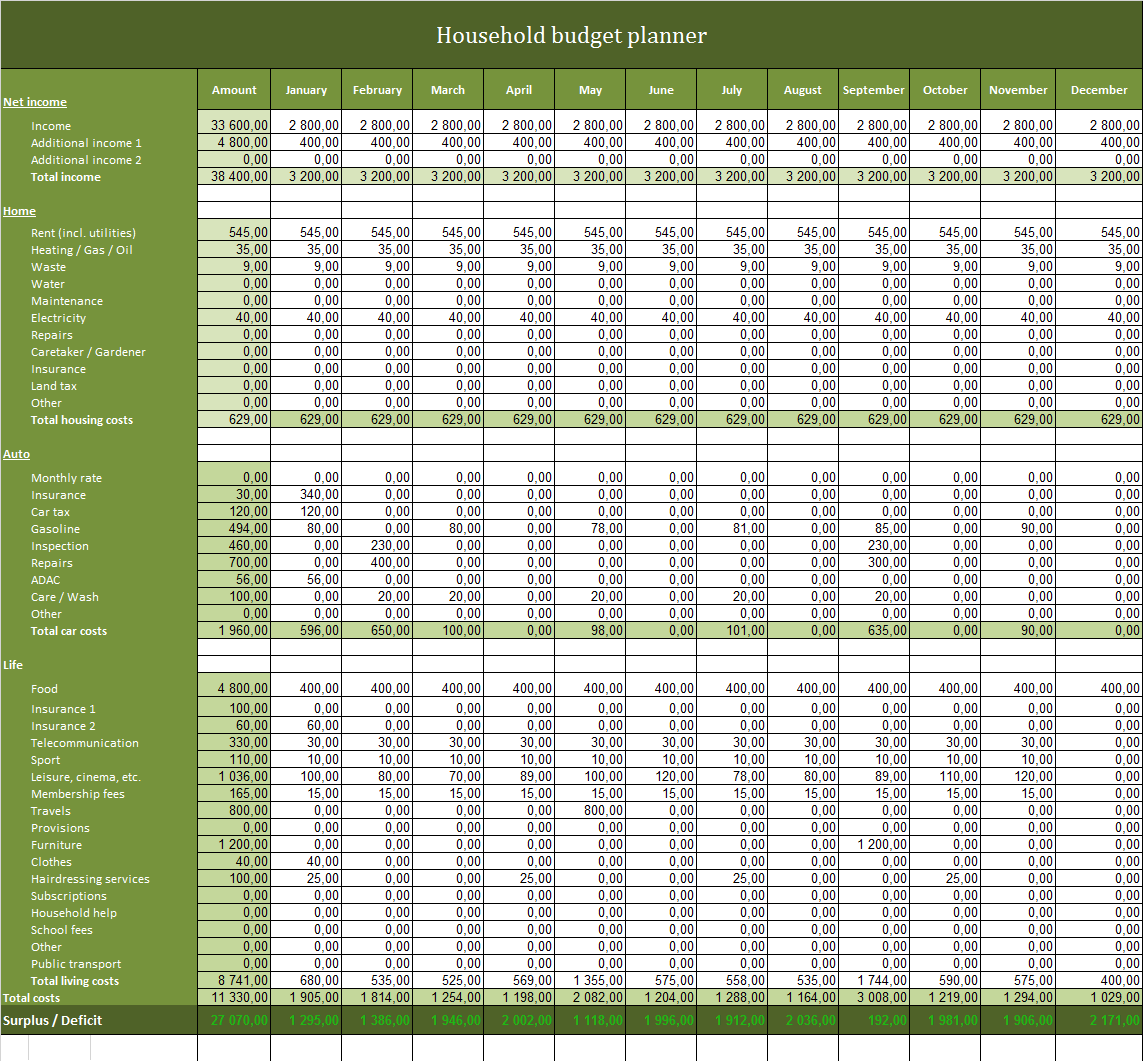

These are the best Excel budget templates to get you started. Luckily, you don’t have to start from scratch. If you want to track and manage a budget, whether for yourself, your household, or a special event, Excel is a great choice. What is the best spreadsheet for a budget?.

How do I create a good budget in Excel?. Personal monthly and yearly budget template. Whether you like to go deep with manually tracking everything you spend, or prefer to digitally set it and forget it, or want something somewhere in between, one of these budgeting spreadsheets (or apps) should help you get successfully started on your financial journey. The Bottom Lineīudgeting can be as simple - or as complicated - as you want to make it. As you set up your next month’s budget, you can take a look at how the small decisions you make impact your finances six months down the road. This tool makes it easy to import your financial data and take a look at your spending habits across the board.īut what I like best about PocketSmith is the future forecasting. You should also take a look at PocketSmith. Then, YNAB’s reporting tools will help you monitor how you’re doing and show you your full financial picture. You’ll simply set goals and log your spending throughout the month. If this spreadsheet doesn’t fit your needs, YNAB has a more extensive budgeting solution that is sure to kick your budget into gear. We have a full list of the best budgeting apps to choose from, but here are two of our favorites. They can connect directly to your bank account, categorize your spending habits, and even automate your bill paying. There are a ton of apps on the market that make tracking your budget a cinch. If you find that a spreadsheet just doesn’t fit your needs, try going digital. Don’t Like Using a Spreadsheet? Try these Budgeting Apps Instead Sticking to a budget is hard, but you’ve got this. Adjust the numbers and start fresh next month. If you do go over one month, don’t let it discourage you. If you need to spend more in one category, reduce the amount in another category to make sure you stay on track. Check in Each WeekĬheck in with your remaining totals at the start of each week and identify areas where you might need to cut back. If you miss a day, jump right back in the next day and log both days. Start Each Month with a ReviewĪt the beginning of the month, review the money you have for each category and adjust your spending accordingly. Here are a few tips to help you get started. Once you have your spreadsheet set up, it’s important to put it to work for you. If that sounds right, then this one-page, super-simple worksheet is for you.ĭownload as PDF Make the Most of Your Spreadsheet If you don’t want to spend a lot of time with your budget, it may be that all you need is a quick chart to jot down what you’ll spend each month. xlsx, try right-clicking the link and selecting ‘Save Link As.’ĭownload for old versions of Excel 97-2003 (.xls) The Really Simple Budget Worksheet This spreadsheet for Excel automatically calculates how much you have left to spend in your monthly budget categories as you input spending on a calendar-like grid. Don’t Like Using a Spreadsheet? Try these Budgeting Apps Instead. Use the download links below to download your own budget spreadsheet and get saving.

How do I create a good budget in Excel?. Personal monthly and yearly budget template. Whether you like to go deep with manually tracking everything you spend, or prefer to digitally set it and forget it, or want something somewhere in between, one of these budgeting spreadsheets (or apps) should help you get successfully started on your financial journey. The Bottom Lineīudgeting can be as simple - or as complicated - as you want to make it. As you set up your next month’s budget, you can take a look at how the small decisions you make impact your finances six months down the road. This tool makes it easy to import your financial data and take a look at your spending habits across the board.īut what I like best about PocketSmith is the future forecasting. You should also take a look at PocketSmith. Then, YNAB’s reporting tools will help you monitor how you’re doing and show you your full financial picture. You’ll simply set goals and log your spending throughout the month. If this spreadsheet doesn’t fit your needs, YNAB has a more extensive budgeting solution that is sure to kick your budget into gear. We have a full list of the best budgeting apps to choose from, but here are two of our favorites. They can connect directly to your bank account, categorize your spending habits, and even automate your bill paying. There are a ton of apps on the market that make tracking your budget a cinch. If you find that a spreadsheet just doesn’t fit your needs, try going digital. Don’t Like Using a Spreadsheet? Try these Budgeting Apps Instead Sticking to a budget is hard, but you’ve got this. Adjust the numbers and start fresh next month. If you do go over one month, don’t let it discourage you. If you need to spend more in one category, reduce the amount in another category to make sure you stay on track. Check in Each WeekĬheck in with your remaining totals at the start of each week and identify areas where you might need to cut back. If you miss a day, jump right back in the next day and log both days. Start Each Month with a ReviewĪt the beginning of the month, review the money you have for each category and adjust your spending accordingly. Here are a few tips to help you get started. Once you have your spreadsheet set up, it’s important to put it to work for you. If that sounds right, then this one-page, super-simple worksheet is for you.ĭownload as PDF Make the Most of Your Spreadsheet If you don’t want to spend a lot of time with your budget, it may be that all you need is a quick chart to jot down what you’ll spend each month. xlsx, try right-clicking the link and selecting ‘Save Link As.’ĭownload for old versions of Excel 97-2003 (.xls) The Really Simple Budget Worksheet This spreadsheet for Excel automatically calculates how much you have left to spend in your monthly budget categories as you input spending on a calendar-like grid. Don’t Like Using a Spreadsheet? Try these Budgeting Apps Instead. Use the download links below to download your own budget spreadsheet and get saving.

Such allocation models are frequently used by banks and other lenders for determining your financial balance. The spreadsheet will also tell you how close you are to an ideal income allocation. Once you’ve entered all the values, the spreadsheet will tell you how much you will have left at the end of the month to save or put toward paying down debt. Enter the monthly amounts in the appropriate categories, estimating any value that fluctuates from month to month.Collect a month’s worth of bills and receipts.Gather your pay stubs and enter your monthly income.Our simple and completely free budget spreadsheet can be used to quickly and easily plan how much you can spend each month. It just takes a bit of organization and commitment - which is much easier when you have a handy spreadsheet already made for you! Keeping track of your budget can feel intimidating at first, but it doesn’t need to be difficult. Loan Payoff Calculator: How Quickly Can You Repay Your Loan?.

Auto Loan Interest Calculator: Monthly Payment & Total Cost. Free Monthly Budget Spreadsheet for Excel & PDF. How To Pay Medical Bills You Can’t Afford. Best Car Insurance For College Students. Should You Get Home Contents Insurance?. How Much Should You Contribute To Your 401(K). How Much Do You Need To Have Saved For Retirement. The Beginner’s Guide To Saving For Retirement. Investment Calculator: How Much Will You Earn?. How To File A FAFSA As An Independent Student. How to refinance your car loan in 7 steps. Best Personal Loans For Excellent Credit. Understanding Overdraft Protection and Fees. Best High-Yield Savings Accounts Compared.

0 kommentar(er)

0 kommentar(er)